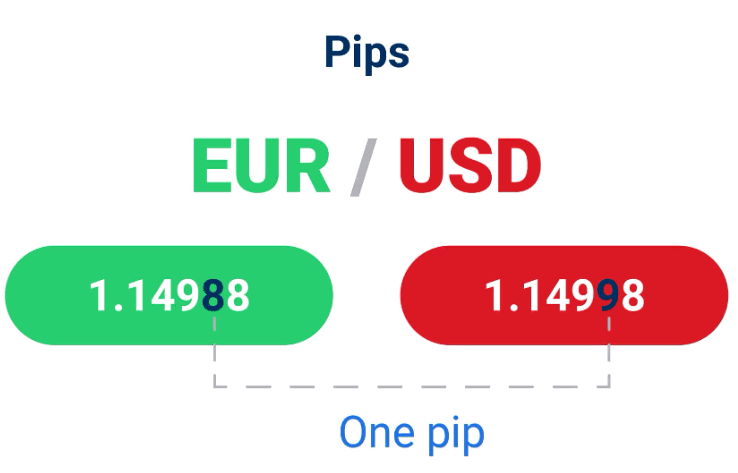

The pip is a significant portion of the currency fluctuation in value and is something to monitor create. Pips are quite important since they are the basis by which a profit or loss is figured. A pip is a simple notion of foreign exchange forex. Dependent on the Lot (Volume), Pips have a certain price. So if you’d like to maximize Forex pips and minimize losses, receive an automatic Forex as you’re trading. The pip is simpler to explain through a good example. The pip is a significant portion of the Forex trade and you’ll see it references through several of the transactions that your robot and place you’re trading on autopilot.

Currencies have to be exchanged to facilitate international trade and company. After the currency is moving in the desired direction its excellent practice to try to enter the trade because it is making a new high or low on that specific trend. As each currency has its very own relative price, it’s vital to compute the worth of a pip for that specific currency pair. The currency isn’t important, what’s important is the difference in the rates between both currencies you’re monitoring.

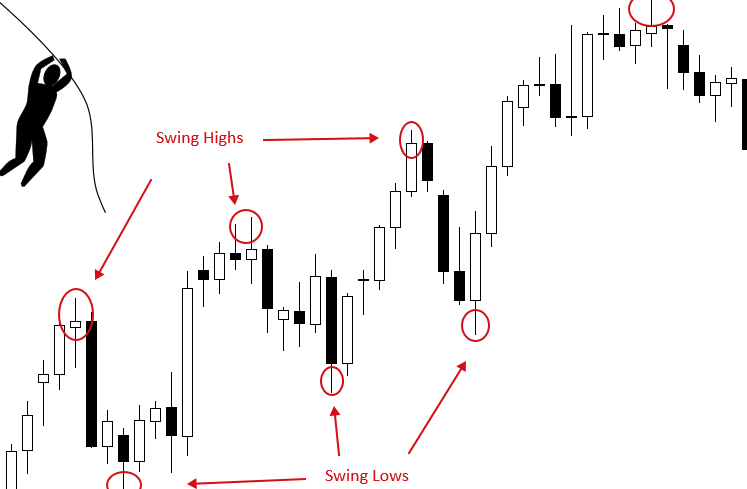

Generally speaking, the marketplace is only trending 15 to 30 percent of the moment. Stock markets aren’t quite as flexible, they close and open each day, and price fluctuations have a tendency to be limited to certain hours daily. In Forex, the market operates by trading currency of a single country to that of another nation. Well, the exact precise issue will apply in the Forex market. Nowadays, the forex market is thought to be the absolute most liquid market in the Earth, primarily as a result of high frequency with which currencies are being exchanged worldwide. It has the capability to give you extremely huge profits, yet at the same time, it also could get you bankrupt overnight. Know The Currency Pairs If you’re likely to enter in the Forex market, you have to first understand currency pairs and what they signify.

An example that Elaborates the Pip More clearly

A trader who buys the EUR/USD will profit if the Euro increases in value relative to the US Dollar. If the trader bought the Euro for 2.1835 and exited the trade at 2.1901, he or she would make 2.1901 – 2.1835=66 pips on the trade.

Another example to make it more clearly for you

USD/JPY is another currency pair most commonly traded and less likely to get high risk, a trader who buy USD/JPY will get loss if the USD decreases in value to the Japanese Yen, if the trader bought the USD in 3.1110 and exited the trade at 2.9110, he or she would make 3.1110-2.9110=0.2 it means the trader will get loss of 2 Pips

Pip is the universal measurer used to exchange/trade currencies in Forex Market.