A wedge is a common trend in finance, but a person who doesn’t know about financial markets, he may understand wedge as a piece of thick wood.

Let’s clear the concept of Wedge in the Financial Market!

A wedge is a common financial pattern known by professional technical traders and market trends commonly used in traded assets, such as bonds, stocks, and futures.

The pattern is characterized by way of a contracting range in prices coupled with an upward trend in charges (referred to as a rising wedge) or a downward trend in charges (called a falling wedge).

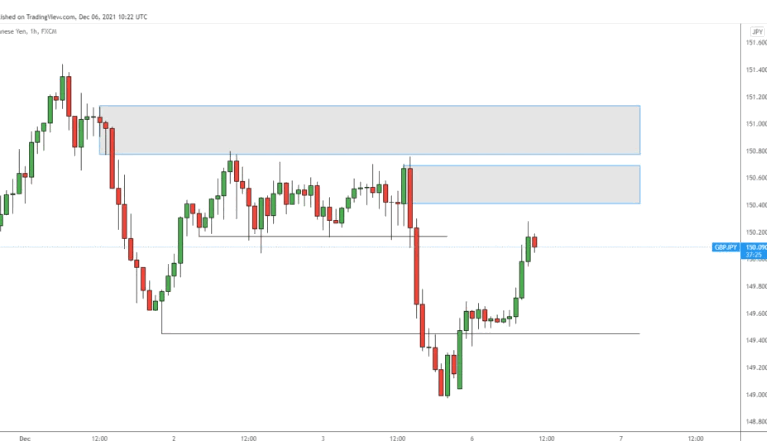

A raising/growing wedge is indicating a reversal pattern frequently seen in bear markets, wedge pattern is shown in the chart, and a single point change either upward, or lower is known as apex.

The chart is created using two trend lines, one line is drawn for showing two or more high apex points and the second line shows two or more low apex points, convergence is visible towards the upper right of the chart.

The formation of wedge patterns is similar to a triangle in appearance, however, trend patterns are distinguished by a noticeable slant, either upward or downward.

A Falling wedge is generally found in uptrends and considered as bullish, but they can also be found in downward trends.

Oppose to falling wedge, a rising wedge is generally found in bearish trends and mostly found in downtrends, but they can also be found in uptrends.

Conclusion

Rising wedges are favorite among the technical traders that are professional in the financial market because rising wedge has relatively low risk and a high reward ratio, but there are some false patterns that may come out as rising wedges.

The only way to distinguish a true rising wedge from a false wedge rising trend is by finding price/volume divergences and to make sure that the failure is still under 50%.