There are many kinds of orders in the forex marketplace, to open a position for virtually any kind in the forex market, you will need to set an order. You might also utilize order blocks to grow your present trades and enter on a pullback. Therefore, you’ve got to specify a buy stop order at 1.0515

One order is put over the current price, and the other order is put below the present market price. For a reason, it’s also called a stop-loss order. A trailing stop-loss forex order makes it possible to do precisely that.

Your trade will stay open provided that price doesn’t move against you by 20 pips. Especially every time a trade unfolds. You can decide to execute a trade at the present market price. If you choose to copy trade, a fixed quantity of your funds get automatically related to the account of the investor whose trades you wish to reproduce. Plan your trade, follow your rules, and you’re going to be on the course towards consistently profitable forex trading very quickly.

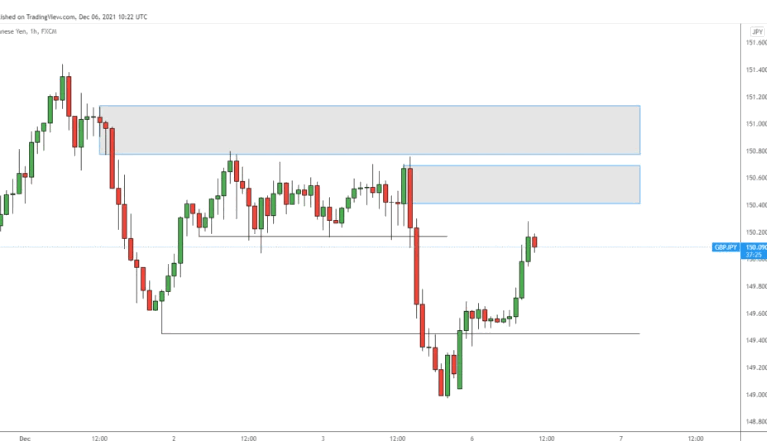

To open a position for virtually any kind in the forex market, you will need to set an order. You might also utilize order blocks to grow your present trades and enter on a pullback. Therefore, you’ve got to specify a buy stop order at 1.0515.

There are Differing kinds of orders are employed in forex trading. The very first thing that you

Should know is what kinds of orders you’ll be able to place on the forex marketplace

- Limit Order

- Market Orders

- Conditional Order

- Entry Order

- Stop Order

Market Orders

Market orders are day orders as they’re executed at the upcoming available price. They are one of the most common orders placed by novice traders. They are executed live on the market at the current price.

Limit Order

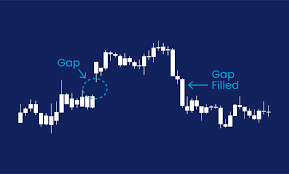

The order is triggered while the market moves in the expected direction. Limit orders guarantee a trade at a specific price. A limit order may be used when you wish to purchase or sell at a particular price. It is a necessary order type that enters an order to buy or sell a futures contract at a specific price or better. It is one that is limited by the amount

A limit order is an order to purchase or sell at a predetermined price or better. It is used to try to take advantage of a specific target price and can be used for both buy and sell orders. Additional, a stop-loss order was made to mitigate an investor’s loss on a post in security.

Conditional Order

A conditional order is any order besides a limit order that’s executed only when a particular condition is satisfied.

There are five types of Conditional Orders

Contingent

Multi Contingent

One Triggers the Other (OTO)

One Cancels the Others (OCO)

One Trigger or One Cancel Other (OTOOCO)

For details of these terms click the link

Entry Order

An entry order is one that is utilized to put in a trade at a predetermined price level. If you do not want that order and you likely don’t, you may have to visit the trouble of manually canceling it. Stop orders may be used to limit losses. You decide you want to place a stop order to purchase 80 pips above and the sector and a stop order to sell 80 pips below the industry. A stop order, on the flip side, is utilized to limit losses. The order stays in the forex trading system until the trader cancels it. In cases where if it does not execute, the then single order will remain dormant and will not be executed when the market reaches the specified rate. There are many types of market orders. They are day orders as

The indication of a trade is positive if it’s the result of a buy market order, and negative if it’s the consequence of a sell. You can’t always trade (at least because in every strategy, there are instances when it is reasonable to enter the industry, and at times it is far better to be out of the market). Plan your trade, follow your rules, and you will be on the course towards consistently profitable forex trading very quickly.

Stop Loss Order

A stop-loss order is a sort of order linked to a trade for the intent of preventing additional losses if the cost goes against you.

In addition to without it. Setting a stop loss also permits you to identify your position size. It is required in order to determine your position size. Hence, it gives the exit from a bad trade.