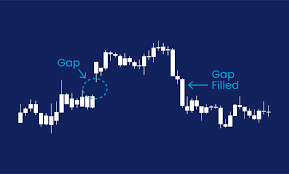

What are the Gaps?

A gap is just an empty space between the closing price of the preceding candle and the opening price of the following candle

When you hear about Gaps, there’s a common saying that Gaps are intended to be filled. Runaway gaps may also happen in downtrends. They are often referred to as measuring gaps because of their tendency to occur at about the middle of a price run. They are formed when there is an extreme sentiment in the market and when bulls or bears overwhelm the other. Exhaustion gaps are likely the simplest to trade and profit from.

Gaps can alternatively be utilized as a confirmation signal. Frequent gaps are somewhat more inclined to be filled within a couple of price bars and can, therefore, be used for very brief term intra-day trading. Just take the opportunity to consider your goods or service and really consider the niche you’re aiming for if it’s already, full, then your company plan has a critical gap

When Gap can occur in trade

Currency Change it occurs when a currency pair jumps from one bar to another with a considerable amount of price distance in between the bars. Most runaway gaps form in the middle of a trend.

Price Pattern An exhaustion gap is the type of gap that’s filled faster. It can be used as a trend reversal signal. Exhaustion gaps can be validated just in hindsight and there is not any guarantee that the trend will reverse simply due to the visual appeal of the exhaustion gap. They are gaps that occur towards the end of extended price moves. They are formed towards the end of the previous trend and indicate the final push in momentum before prices start to lose it and reverse.

Gaps are really enjoyable to trade if you know what you’re doing. As a result, although it is a fact that gaps are intended to be filled, there isn’t any saying in the length of time it may take for the gap to be filled. A breakaway gap is like a seismic shift that could alter the probable route of price action for an important period of time to come.

Gaps sometimes bring about corrective price action. In case you have, then what you’ve observed is referred to as a gap in the marketplace. After the market gaps past your intended entry price, you may still enter the marketplace.

Gaps represent the greatest supply and demand imbalance that’s key when trying to determine market turning points trading gaps isn’t a simple feat, as it requires an immense amount of discipline, because you’re trading the most volatile length of the day.

The more you work, the more you’re able to be compelled to take part in trades. The trade than might be held until the conclusion of the trading session. By that moment, it’s usually obvious that something is wrong with the trade and you ought to exit your position.

Preferably, continuation gaps aren’t extremely large in size to verify sustainability. They can arise in the middle of any price trend. Because a continuation gap occurs in the center of a trend, it’s a substantial warning that risk is quite high for counter-trend traders and could be an intriguing entry opportunity for new trades.

Identifying and Filling the Gaps

As you practice identifying gaps there are some more concepts you must keep in mind. Measuring gaps have a tendency to appear in rather strong trends that have seen virtually minimum price retracements. They are the most difficult to spot. You are able to sell a positive gap.

You might learn to successfully trade gaps all on your own, but you also might not. You’ll also learn the way the causes of gaps can be recognized in gapless markets so the very same signals can be traded there. Most typical gaps are filled the exact same day they are created. It’s well worth noting that breakaway gaps usually arrive with an important increase in trading volume. Needless to say, a breakaway gap is validated only if the price proceeds to move in the exact direction of the breakaway gap and has the capability to keep the trend.

Gaps are part of the experience of every forex trader. Trading gaps isn’t a one-way street, though. Moreover, day trading gaps will not ever be the exact same.

Gaps are due to information or changes in investor sentiment that’s released while the sector is closed or not trading. They also are one of the most confounding occurrences. Therefore, trading gaps for everyday profit may wind up in great losses.

The strategy can be applied to any market as long because there are gaps in the cost. Upon understanding the forms of gaps, strategies are employed to take advantage of those. A great gap trading strategy works for all kinds of gaps.

What Are Slippage

Forex slippage is an instance of a pretty normal forex trading occurrence that is normally spoken of as a poor thing. It can also occur on normal stop losses whereby the stop loss level cannot be honored.

Although it is normally associated with negative market movement, it can occur in any direction, which means that you can also experience positive slippage. Another reason for slippage is a tremendous volume.

To put it simply, slippage is the difference between the price tag you see and the price that you pay. Negative slippage is an extra loss, while the positive one is an extra profit. One that you’ll definitely find is referred to as slippage. In the example of stock trading, slippage is a consequence of a change in spread. In most instances, the biggest slippage will happen around major, market-moving news events.

When Slippage can occur in trade

Slippage happens when no one wishes to open a trade at your preferred price. When it occurs, you can lose some of the possible profits, it is usually a few points. Irrespective of the forex broker you trade with

Slippage is more inclined to occur during intervals of high market volatility

Slippage can happen during intervals of low market volatility

Eliminate the Slippage

There’s no chance of slippage here. It is an impossible task to eliminate the chance of slippage completely. The simple fact that you’re slipping on trade isn’t necessarily a poor thing. The main reason for that is how markets are illiquid during some times in a trading day, and the broker can’t fill tremendous volume in the event the price happens to accomplish your entry-level during such a moment.