FOMC Meeting Taking place eight times per year, the meeting is a significant event for all traders to get ready for. The FOMC meeting remains an important financial event beyond the USA too. Below, you will discover all you will need to learn about FOMC meetings, for example, schedule, which means you can develop effective forex trading strategies.

All eight meetings in 2019 are followed by means of a press conference and ought to be considered live. FOMC meetings are largely positive for the stock industry. In my opinion, today’s FOMC meeting is not going to send an aggressive message to the sector and even in the event the FED wants to cut the rates of interest for the remainder of the calendar year, still the financial situation of America is much superior to Europe.

As a consequence, rates of interest on auto and other short-term loans rise together with the fed funds rate. Additionally, if the reduced interest rate is still higher than other nations, the decline in the USA dollar’s value may not be as significant. A lower rate of interest rate might lessen the worth of the US dollar, which means a brief position may be wise. It provides a lower rate of interest than other bonds.

Which Factors are impacted

- Dollar

- Gold

- Indices

- Bonds

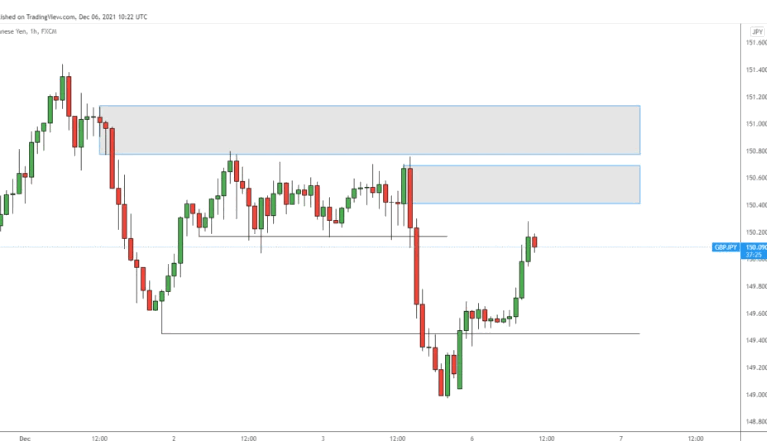

How might traders adjust their strategy? Traders are always thinking for long term and they are already prepared before the meeting of FOMC by looking an eye on the trends, they can easily predict the results of FOMC Meeting but after the results they formulate there trade strategy more comprehensively.