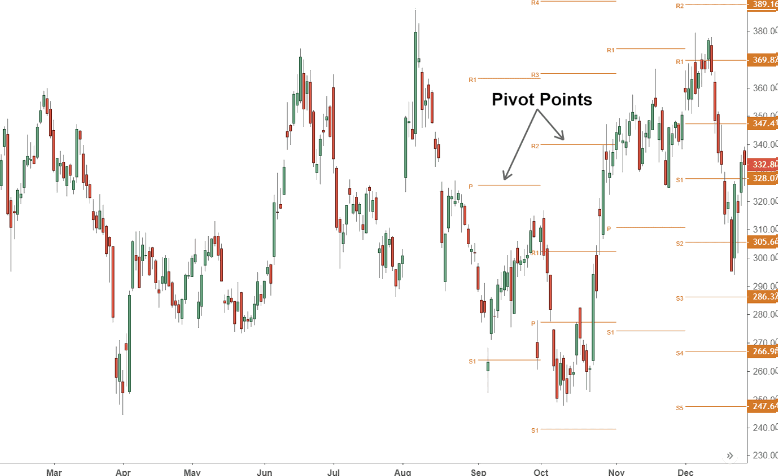

Pivot points are among the most commonly used indicators in day trading. They are extremely helpful resources which make use of the prior bars’ levels, levels as well as closings in order to task assistance as well as opposition amounts with regard to long term pubs. As you finally have the fundamental pivot stage, you are now able to figure out the very first support and resistance.

Pivot points are especially beneficial to short-term traders that are seeking to benefit from small price movements. They offer a way to find price direction. Pivot points on charts supply a rich set of information.

Pivot points have the benefit of being a major indicator, meaning traders may use the indicator to gauge potential turning points on the market in advance. The reason pivot points are so popular is they’re predictive instead of lagging.

Pivot points may be used in two ways. They are considered very forex nightfox, since they are calculated using a precise formula. They are one of the most widely used indicators in day trading. Because you finally have the fundamental pivot stage, you are now able to figure out the very first support and resistance. When you use the simple pivot point and the 3 support and resistances, there’ll be 7 distinct levels.

Traders may make an effort to have a look at breaks of each support or resistance level as a chance to go into a trade in a fast-moving sector. Range-bound traders utilize pivot points to detect reversal points. For instance, a trader might put in a limit order to get 100 shares if the cost breaks a resistance level. Traders appearing to benefit from price moving within a range will look to buy at the base of the range and sell on top of the range.

Pivot Point Calculation

The calculation for a pivot point is shown below:

- Pivot point (PP)=(High + Low + Close) / 3.

- First resistance (R1)=(2 x PP) – Low.

- First support (S1)=(2 x PP) – High.

- Second resistance (R2)=PP + (High – Low)

- Second support (S2)=PP – (High – Low)

- Third resistance (R3)=High + 2(PP – Low)

The above written is the formula of pivot point calculation, but this is only for your understanding you’re not going to need to execute the calculations involved manually. The pivot point’s calculation for trading is more useful once you pick time frames having the maximum volume and many liquidities. The forex pivot point calculator can be convenient, especially if you wish to do a small backtesting to learn how pivot point levels have held up in the past. Pivot Points Calculator There are several online pivot point calculators on the internet. Pivots can likewise be calculated for much shorter time frames, like the hourly or 15-minute charts.