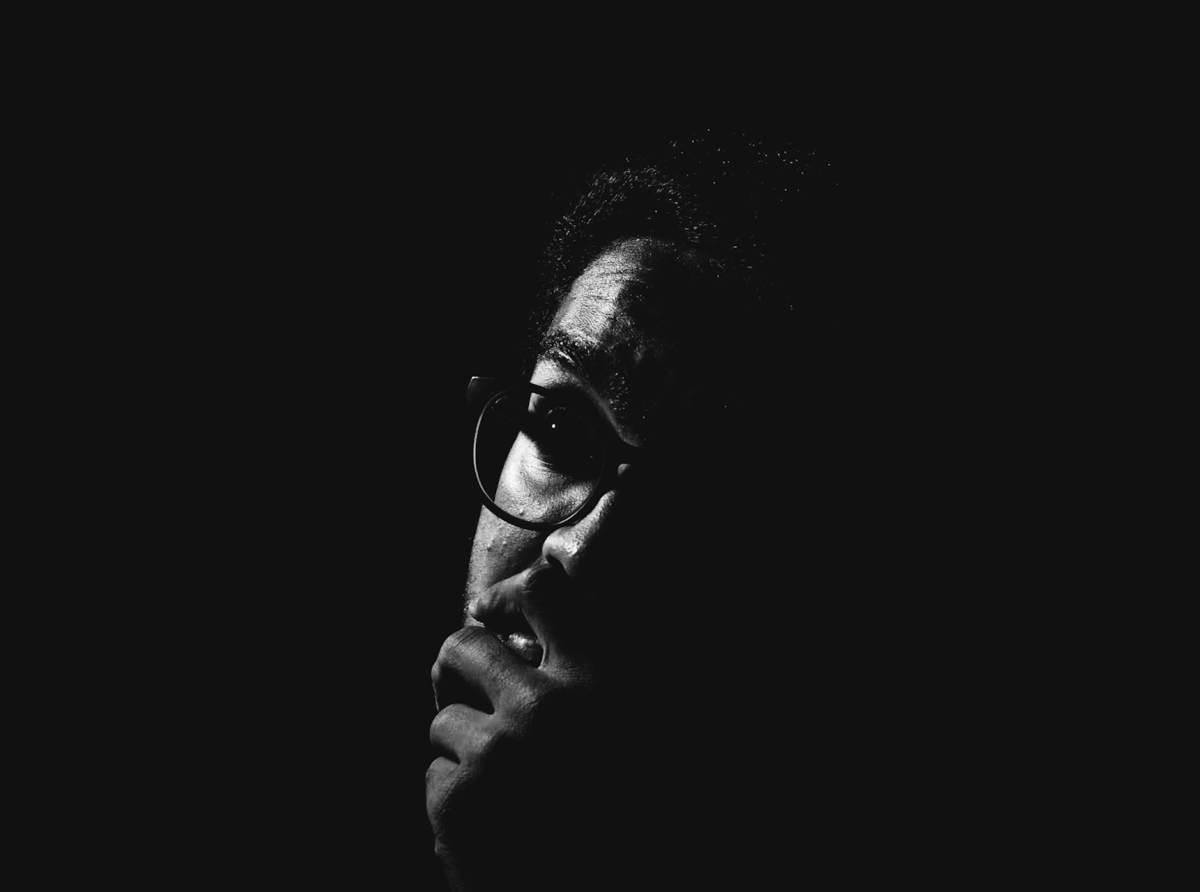

Why Psychology Matters More Than You Think

Forex trading isn’t just about strategy, charts, and market analysis—it’s a mental game. While tools and technical skills are essential, a trader's psychology often determines success or failure. Emotions like fear, greed, and overconfidence can disrupt even the best strategies, leading to irrational decisions and significant losses.

Why Psychology Matters More Than You Think

The Psychological Pitfalls That Harm Traders

1. Fear of Missing Out (FOMO)This is the urge to jump into a trade too late, driven by the fear of missing profits others might be making. It leads to poor entry points, unnecessary risks, and deviation from planned strategies.

2. Overtrading and Revenge Trading

After a loss, many traders try to win back money quickly by placing more trades, often without proper analysis. This emotional reaction—called revenge trading—magnifies losses and increases psychological stress.

3. Impatience

Forex markets can be slow to move, and impatience often causes traders to exit trades too early or enter without solid setups. This results in missed opportunities and inconsistent performance.

4. Greed

Chasing bigger profits without adjusting stop-loss or take-profit levels often ends in disaster. Holding a winning position for “just a bit more” can cause the market to turn and wipe out gains.

5. Fear of Loss

Some traders are so afraid of losing money that they never execute trades, or they close them too early. This fear creates hesitation and prevents the application of any strategy consistently.

Key Psychological Traits of Successful Traders

1. DisciplineDiscipline means following a trading plan regardless of emotional distractions. Successful traders don’t chase trades—they wait for setups and follow risk management rules without exception.

2. Patience

A good trader knows that not every market condition is worth entering. Waiting for the right moment separates professionals from gamblers.

3. Emotional Control

Accepting both wins and losses without panic or excitement is crucial. Trading is a long-term game—single wins or losses should not emotionally dominate your mindset.

4. Self-Awareness

Understanding your emotional triggers—like what causes you to overtrade or hesitate—can help you address weaknesses and improve decision-making over time.

How to Strengthen Your Trading Psychology

Keep a Trading Journal: Track not only your trades but also your emotions and thoughts during each trade.Set Realistic Goals: Aim for consistency, not instant wealth. Small, regular gains compound over time.

Use Proper Risk Management: Never risk more than you can afford to lose. A common rule is 1-2% of your account per trade.

Take Breaks: Don’t trade when stressed, tired, or emotionally unstable. Mental clarity is a key trading tool.

In Forex, having the right mindset is just as important as having the right tools. Psychological resilience, emotional discipline, and self-awareness form the foundation of any successful trading journey. As much as charts and indicators matter, it’s what’s happening in your mind that often determines the outcome of each trade.

Report

My comments