Every Forex broker charges fees in one form or another and there are trading costs associated with each trade placed. Many traders often ignore the total cost per trade which can make a big difference to the overall outcome of a portfolio. While the most obvious cost is through spreads, there are other fees and costs that are applicable and should not be ignored. Transparent brokers will always be upfront about their fees and list them either on their website, in their trading platform with each trade ticket (or, ideally, in both places).

Overview of Direct Trading Costs

Direct trading costs consist of spreads, commissions, swap rates, overnight financing costs, storage fees and custodial fees. Not all costs apply to every trade and it all depends on which asset is traded if it is traded on margin and the duration of each trade. All costs involved with each trade should be mentioned by the broker; transparent brokers list them in their trading conditions and also provide examples of how costs are incurred and calculated. In addition, trading costs can be found inside the trading platform. This is especially true if the broker offers a proprietary trading platform. Calculators are also provided which allow traders to calculate the cost of each trade before placing it.

Spreads

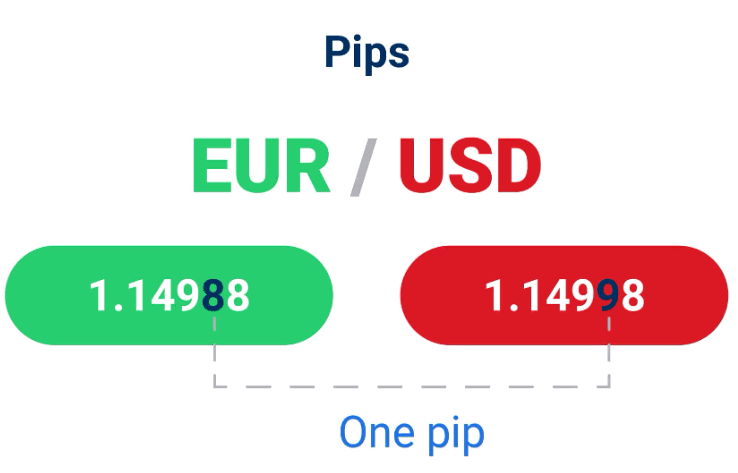

Spreads are the most obvious cost associated with trade and refer to the difference between the bid and ask price. Spreads are the primary income source for brokers who live from the mark-up on raw spreads. Raw spreads can be as low as 0.0 pips in the EUR/USD, the most liquid currency pair which carries the lowest spread. Everything above this level is the mark-up the broker charges.

While spreads are listed on each broker’s website, traders can easily view them in their trading terminal.

Commissions

Some accounts may come with spreads as low as 0.0 pips on the EUR/USD, but the broker charges a commission per lot. Accounts which charge commissions are usually ECN accounts which operate a no-dealing desk execution. Traders get the raw spreads, or very close to it, and in exchange the broker charges a commission.

Commissions are also charged on equity trades and various other assets (ETFs, ETC’s, bonds, etc.) will carry a commission charge. In order to get the full details on which assets carry a commission, traders should either consult the asset directory provided by their broker or get the information directly from the trading platform. Transparent brokers will list the full contract specifications on their website while proprietary trading platforms list all the information in each deal ticket. Volume discounts are often given to account which carry commissions.

Swap Rates

Swap rates, someday referred to rollover rates, apply to each position which is held overnight. Swap rates occur due to the interest rate differences in the base currency and the quote currency. Brokers will list how this rate is calculated and there is a Swap Long and a Swap Short rate. Depending on if the traders take a long or short positions, swap rates will either be credited from or debited to the account balance. A lot of brokers fail to forward positive swap rates to traders.

Forex traders can check the precise swap in their MT4 Trading Platform by following these steps:

Right-click on the desired symbol in the “Market Watch” window and select “Symbols”.

Select the desired currency and then click on “Properties” located on the right side.

Scroll down until you see “Swap Long” and “Swap Short”

Overnight Financing Costs

This is a cost related to margin trades. Brokers will explain how the effective overnight financing rate is calculated. It depends on the amount of leverage used per trade and which asset is traded. This is an important cost to monitor as it increases the longer an asset remains open in the account.

Storage Fees

Some brokers will charge traders a storage fee for holding certain assets. This is an unnecessary fee, but will be charged for holding positions in the account which comes on top of swap and/or financing fees. In essence it is a fee charged for maintaining positions in your portfolio. Brokers who charge storage fees should be avoided.

Custodial Fees

Equity, ETF and bonds come with custodial fees which are usually a small percentage charged annualized but may be deducted monthly with a minimum. Not all brokers offer equity or bond trading and use CFDs which are great to get in on the price action without the need to incur custodial fees.

Overview of Indirect Trading Costs

Indirect trading costs are costs which are not charged per trade, but include costs such as withdrawal charges and account inactivity fees. Deposit charges are waived by all brokers, which is standard industry practice. Some brokers even reimburse their traders for deposits made via bank wire which is usually charged by the trader’s bank. Withdrawal fees are usually not charged by brokers, but third-party fees may apply such as bank wire charges. All charges relating to deposits and withdrawals should be listed on the broker’s website.

Another unnecessary fee which some brokers charge is an account inactivity fee. This is usually applied after three months of no trading activity. The broker will then charge a quarterly cost, which will be listed in the trading conditions of the broker’s website, until the account balance is either depleted or trading resumed.

In general, all fees which a broker can charge will be listed in their website under trading conditions. Traders should carefully review this section as the lesser known costs are only mentioned there. In case this information is not provided, the broker is better avoided. Customer service can be contacted, but again, a transparent and trustworthy broker will not hide their costs. Costs like spreads and swaps are best accessed directly from the trading platform as they can change quickly due to market conditions. Using cost calculators provide by brokers can also be used in order to determine precise costs per asset and volume traded.

This is one of those articles that can cause a lot of discussion on the Internet. The reason for that is I will be discussing something that a lot of Forex traders don’t want to admit: Forex trading can be quite risky. I believe that is a situation that far too few traders pay attention to, as it’s natural for people to fantasize about all of the money they’ll be raking in while sitting on the beach, using either a smart phone or a laptop. The reality about trading currencies is quite different though, even if you don’t want to hear it.

Some hard truths

Some hard truths about trading currency that people don’t want to hear is that beyond the leverage, there isn’t much difference between trading currencies, commodities, or even stocks. While I’m aware of the fact that there are some subtle nuances, at the end of the day you are either trying to buy at an uptrend or sell in a downtrend. (Unless of course you’re a counter trend trader, but I bet very few are successful at that style.) So having said that, the only real difference between Forex trading and many other types of trading is the massive amounts of leverage that are available. Therein lies the rub.

It’s about marketing

Forex trading can be extraordinarily dangerous if you don’t know what you’re doing. The ability to trade as much as 1000 times the amount of money you put up is absolutely insane. Nothing good comes of these extraordinarily high leverage levels, although marketing professionals would have you believe different. Put it this way: “How many times have you seen a Forex advert featuring a private jet, exotic car, or sailboat?”

Undercapitalization

It astonishes me how many people believe that they are going to become wealthy with a small trading account. It’s not that you can’t grow a trading account over the longer-term, but most people to start that patient. They put $1000 into an account, looking to make $1 million by the time it’s all said and done. They don’t understand that some of the best traders in the world average 20% a year. On a $1000 account that’s only $200. Being undercapitalized is without a doubt one of the biggest disadvantages that retail traders face. It’s difficult to get excited about making $200 over the course of the year.

There is no secret formula

The reality is there is no secret formula when it comes to making money in the Forex world. What I mean by this is you will undoubtedly come across the idea of some type of magical formula or system, or even indicator that can make you rich. On top of that, somebody will be more than willing to sell it to you for $99! Can you imagine the generosity of someone who makes that kind of money to give you these powerful tools for just a few dollars? Or, is it more likely that they are trying to sell you something to make money rather than use it for their own account? The reality is that the most profitable advice that people can give you is to simply dial back the leverage and use psychological discipline, something that most people fail miserably at. In fact, a serious argument can be made for the system being somewhat irrelevant, as even some of the most basic trading systems have been proven to make money over the long run. The question then becomes whether or not you as a person can psychologically take trading.

It’s not all bad news

I’ll be honest here: I’m not extraordinarily wealthy or anything like that. I haven’t made millions trading, but I have made a reasonable amount of money. However, beyond making a few thousand dollars here and there, I have gained much more than monetary value trading Forex. One of the biggest surprises for traders to stick with it is just how much it opens up your eyes to the rest of the world. You begin to look at the psychological aspects of everything, and some of the lessons that you will learn far outweigh anything that you can gain in a bank account.

I think at this point the most important thing to take away from this article is that Forex should be thought of more or less as a puzzle. It’s nothing more, nothing less. There’s nothing exotic about trading Forex in relation to other markets that you can be involved with. At the end of the day, you aren’t taking delivery of €100,000, so what’s the difference if you trade the Euro, or you trade Walmart? However, having the ability to use so much leverage can teach you lessons about becoming a better trader in other markets as well.

As soon as you realize just how deadly leverage can be, as well as helpful, you then begin to learn how to become a true trader. In fact, some of the best traders I know started out in Forex and then got involved in other markets such as bonds or oil. At the end of the day, you learn market dynamics with a very small deposit, and several life lessons. Beyond that, if you do learn these lessons, you can make a strong return on whatever money you do have.

Forex Trading: A Beginner’s Guide

BY ADAM BARONE

Updated Sep 14, 2019

TABLE OF CONTENTS

EXPAND

- What Is the Forex Market?

- A Brief History of Forex

- Spot Market and the Forwards & Futures Markets

- Forex for Hedging

- Forex for Speculation

- Currency as an Asset Class

- Why We Can Trade Currencies

- Forex Trading Risks

- Pros and Challenges of Trading Forex

- The Bottom Line

Forex is a portmanteau of foreign currency and exchange. Foreign exchange is the process of changing one currency into another currency for a variety of reasons, usually for commerce, trading, or tourism. According to a recent triennial report from the Bank for International Settlements (a global bank for national central banks), the average was more than $5.1 trillion in daily forex trading volume.

KEY TAKEAWAYS

- The foreign exchange (also known as FX or forex) market is a global marketplace for exchanging national currencies against one another.

- Because of the worldwide reach of trade, commerce, and finance, forex markets tend to be the largest and most liquid asset markets in the world.

- Currencies trade against each other as exchange rate pairs, for instance, EUR/USD.

- Forex markets exist as spot (cash) markets as well as derivatives markets offering forwards, futures, options, and currency swaps.

- Market participants use forex to hedge against international currency and interest rate risk, to speculate on geopolitical events, and to diversify portfolios, among several other reasons.

What Is the Forex Market?

The foreign exchange market is where currencies are traded. Currencies are important to most people around the world, whether they realize it or not, because currencies need to be exchanged in order to conduct foreign trade and business. If you are living in the U.S. and want to buy cheese from France, either you or the company that you buy the cheese from has to pay the French for the cheese in euros (EUR). This means that the U.S. importer would have to exchange the equivalent value of U.S. dollars (USD) into euros. The same goes for traveling. A French tourist in Egypt can’t pay in euros to see the pyramids because it’s not the locally accepted currency. As such, the tourist has to exchange the euros for the local currency, in this case, the Egyptian pound, at the current exchange rate.

One unique aspect of this international market is that there is no central marketplace for foreign exchange. Rather, currency trading is conducted electronically over-the-counter (OTC), which means that all transactions occur via computer networks between traders around the world, rather than on one centralized exchange. The market is open 24 hours a day, five and a half days a week, and currencies are traded worldwide in the major financial centers of London, New York, Tokyo, Zurich, Frankfurt, Hong Kong, Singapore, Paris and Sydney—across almost every time zone. This means that when the trading day in the U.S. ends, the forex market begins anew in Tokyo and Hong Kong. As such, the forex market can be extremely active any time of the day, with price quotes changing constantly.

A Brief History of Forex

Unlike stock markets, which can trace their roots back centuries, the forex market as we understand it today is a truly new market. Of course, in its most basic sense – that of people converting one currency to another for financial advantage – forex has been around since nations began minting currencies. But the modern forex markets are a modern invention. After the accord at Bretton Woods in 1971, more major currencies were allowed to float freely against one another. The values of individual currencies vary, which has given rise to the need for foreign exchange services and trading.

Commercial and investment banks conduct most of the trading in the forex markets on behalf of their clients, but there are also speculative opportunities for trading one currency against another for professional and individual investors.

Spot Market and the Forwards & Futures Markets

There are actually three ways that institutions, corporations and individuals trade forex: the spot market, the forwards market and the futures market. The forex trading in the spot market always has been the largest market because it is the “underlying” real asset that the forwards and futures markets are based on. In the past, the futures market was the most popular venue for traders because it was available to individual investors for a longer period of time. However, with the advent of electronic trading and numerous forex brokers, the spot market has witnessed a huge surge in activity and now surpasses the futures market as the preferred trading market for individual investors and speculators. When people refer to the forex market, they usually are referring to the spot market. The forwards and futures markets tend to be more popular with companies that need to hedge their foreign exchange risks out to a specific date in the future.

More specifically, the spot market is where currencies are bought and sold according to the current price. That price, determined by supply and demand, is a reflection of many things, including current interest rates, economic performance, sentiment towards ongoing political situations (both locally and internationally), as well as the perception of the future performance of one currency against another. When a deal is finalized, this is known as a “spot deal”. It is a bilateral transaction by which one party delivers an agreed-upon currency amount to the counterparty and receives a specified amount of another currency at the agreed-upon exchange rate value. After a position is closed, the settlement is in cash. Although the spot market is commonly known as one that deals with transactions in the present (rather than the future), these trades actually take two days for settlement.

Unlike the spot market, the forwards and futures markets do not trade actual currencies. Instead they deal in contracts that represent claims to a certain currency type, a specific price per unit and a future date for settlement.

In the forwards market, contracts are bought and sold OTC between two parties, who determine the terms of the agreement between themselves.

In the futures market, futures contracts are bought and sold based upon a standard size and settlement date on public commodities markets, such as the Chicago Mercantile Exchange. In the U.S., the National Futures Association regulates the futures market. Futures contracts have specific details, including the number of units being traded, delivery and settlement dates, and minimum price increments that cannot be customized. The exchange acts as a counterpart to the trader, providing clearance and settlement.

Both types of contracts are binding and are typically settled for cash for the exchange in question upon expiry, although contracts can also be bought and sold before they expire. The forwards and futures markets can offer protection against risk when trading currencies. Usually, big international corporations use these markets in order to hedge against future exchange rate fluctuations, but speculators take part in these markets as well.

Note that you’ll see the terms: FX, forex, foreign-exchange market and currency market. These terms are synonymous and all refer to the forex market.

Forex for Hedging

Companies doing business in foreign countries are at risk due to fluctuations in currency values when they buy or sell goods and services outside of their domestic market. Foreign exchange markets provide a way to hedge currency risk by fixing a rate at which the transaction will be completed.

To accomplish this, a trader can buy or sell currencies in the forward or swap markets in advance, which locks in an exchange rate. For example, imagine that a company plans to sell U.S.-made blenders in Europe when the exchange rate between the euro and the dollar (EUR/USD) is €1 to $1 at parity.

The blender costs $100 to manufacture, and the U.S. firm plans to sell it for €150—which is competitive with other blenders that were made in Europe. If this plan is successful, the company will make $50 in profit because the EUR/USD exchange rate is even. Unfortunately, the USD begins to rise in value versus the euro until the EUR/USD exchange rate is .80, which means it now costs $0.80 to buy €1.00.

The problem the company faces is that it, while it still costs $100 to make the blender, the company can only sell the product at a competitive price of €150, which when translated back into dollars is only $120 (€150 X .80=$120). A stronger dollar resulted in a much smaller profit than expected.

The blender company could have reduced this risk by shorting the euro and buying the USD when they were at parity. That way, if the dollar rose in value, the profits from the trade would offset the reduced profit from the sale of blenders. If the USD fell in value, the more favorable exchange rate will increase the profit from the sale of blenders, which offsets the losses in the trade.

Hedging of this kind can be done in the currency futures market. The advantage for the trader is that futures contracts are standardized and cleared by a central authority. However, currency futures may be less liquid than the forward markets, which are decentralized and exist within the interbank system throughout the world.

Forex for Speculation

Factors like interest rates, trade flows, tourism, economic strength and geopolitical risk affect supply and demand for currencies, which creates daily volatility in the forex markets. An opportunity exists to profit from changes that may increase or reduce one currency’s value compared to another. A forecast that one currency will weaken is essentially the same as assuming that the other currency in the pair will strengthen because currencies are traded as pairs.

Imagine a trader who expects interest rates to rise in the U.S. compared to Australia while the exchange rate between the two currencies (AUD/USD) is .71 (it takes $.71 USD to buy $1.00 AUD). The trader believes higher interest rates in the U.S. will increase demand for USD, and therefore the AUD/USD exchange rate will fall because it will require fewer, stronger USD to buy an AUD.

Assume that the trader is correct and interest rates rise, which decreases the AUD/USD exchange rate to .50. This means that it requires $.50 USD to buy $1.00 AUD. If the investor had shorted the AUD and went long the USD, he or she would have profited from the change in value.

Currency as an Asset Class

There are two distinct features to currencies as an asset class:

- You can earn the interest rate differential between two currencies.

- You can profit from changes in the exchange rate.

An investor can profit from the difference between two interest rates in two different economies by buying the currency with the higher interest rate and shorting the currency with the lower interest rate. Prior to the 2008 financial crisis, it was very common to short the Japanese yen (JPY) and buy British pounds (GBP) because the interest rate differential was very large. This strategy is sometimes referred to as a “carry trade.”

Why We Can Trade Currencies

Currency trading was very difficult for individual investors prior to the internet. Most currency traders were large multinational corporations, hedge funds or high-net-worth individuals because forex trading required a lot of capital. With help from the internet, a retail market aimed at individual traders has emerged, providing easy access to the foreign exchange markets, either through the banks themselves or brokers making a secondary market. Most online brokers or dealers offer very high leverage to individual traders who can control a large trade with a small account balance.

Volume 75%

1:52

Forex Trading: A Beginner’s Guide

Forex Trading Risks

Trading currencies can be risky and complex. The interbank market has varying degrees of regulation, and forex instruments are not standardized. In some parts of the world, forex trading is almost completely unregulated.

The interbank market is made up of banks trading with each other around the world. The banks themselves have to determine and accept sovereign risk and credit risk, and they have established internal processes to keep themselves as safe as possible. Regulations like this are industry imposed for the protection of each participating bank.

Since the market is made by each of the participating banks providing offers and bids for a particular currency, the market pricing mechanism is based on supply and demand. Because there are such large trade flows within the system, it is difficult for rogue traders to influence the price of a currency. This system helps create transparency in the market for investors with access to interbank dealing.

Most small retail traders trade with relatively small and semi-unregulated forex brokers/dealers, which can (and sometimes do) re-quote prices and even trade against their own customers. Depending on where the dealer exists, there may be some government and industry regulation, but those safeguards are inconsistent around the globe.

Most retail investors should spend time investigating a forex dealer to find out whether it is regulated in the U.S. or the U.K. (dealers in the U.S. and U.K. have more oversight) or in a country with lax rules and oversight. It is also a good idea to find out what kind of account protections are available in case of a market crisis, or if a dealer becomes insolvent.

Pros and Challenges of Trading Forex

Pro: The forex markets are the largest in terms of daily trading volume in the world and therefore offer the most liquidity. This makes it easy to enter and exit a position in any of the major currencies within a fraction of a second for a small spread in most market conditions.

Challenge: Banks, brokers and dealers in the forex markets allow a high amount of leverage, which means that traders can control large positions with relatively little money of their own. Leverage in the range of 100:1 is a high ratio but not uncommon in forex. A trader must understand the use of leverage and the risks that leverage introduces in an account. Extreme amounts of leverage have led to many dealers becoming insolvent unexpectedly.

Pro: The forex market is traded 24 hours a day, five days a week—starting each day in Australia and ending in New York. The major centers are Sydney, Hong Kong, Singapore, Tokyo, Frankfurt, Paris, London and New York.

Challenge: Trading currencies productively requires an understanding of economic fundamentals and indicators. A currency trader needs to have a big-picture understanding of the economies of the various countries and their inter-connectedness to grasp the fundamentals that drive currency values.

The Bottom Line

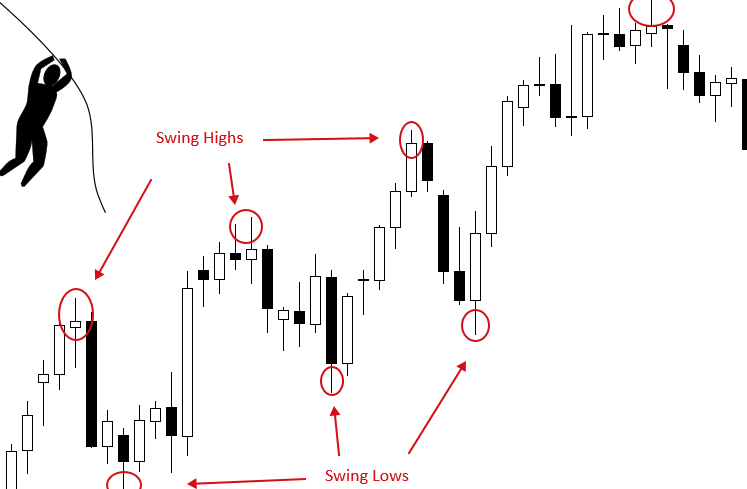

For traders—especially those with limited funds—day trading or swing trading in small amounts is easier in the forex market than other markets. For those with longer-term horizons and larger funds, long-term fundamentals-based trading or a carry trade can be profitable. A focus on understanding the macroeconomic fundamentals driving currency values and experience with technical analysis will help new forex traders to become more profitable. (For related reading, see “Benefits & Risks of Trading Forex with Bitcoin“)

One of the underlying tenets of technical analysis is that historical price action predicts future price action. Since the forex market is a 24-hour market, there tends to be a large amount of data that can be used to gauge future price movements. This makes it the perfect market for traders that use technical tools.

SPONSORED

Get 15% welcome bonus up to $500

Trade forex and CFDs on stock indices, commodities, stocks, metals and energies with a licensed and regulated broker. For all clients who open their first real account, XM offers a 15% welcome bonus up to $500 to test the XM products and services without any initial deposit needed. Learn more about how you can trade over 1000 instruments on the XM MT4 and MT5 platforms from your PC and Mac, or from a variety of mobile devices.